The importance of Construction Bonds in Mauritius

Catégorie : Articles

How Insurance and Reinsurance fit in

In any construction project, one constant remains: risk. Whether it is a delay in delivery, a contractor abandoning the site, or a budget overrun, things can go wrong. And when millions are at stake, clients want more than just good faith. That is where Construction Bonds (also known as ‘‘Contract Bonds’’) come in.

These are guarantees issued by Insurers or banks, that assure the Client that the contractor will fulfil its contractual obligations. If the contractor fails, the bond issuer (Surety) compensates the Client, often up to the bond amount.

The main types include:

- Bid Bond: Ensures the contractor will honour the bid and sign the contract.

- Performance Bond: Guarantees completion of the works as per contract terms.

- Advance Payment Bond: Protects the Client if the contractor fails after receiving an advance payment.

- Retention Bond: Replaces the need to withhold retention money by offering a bond as security – typically applicable during the maintenance period of the project.

Why are they essential?

Construction bonds serve three critical functions:

1. Risk Mitigation

They protect the client from financial losses caused by default, delay, or poor performance.

2. Cash Flow Support

Bonds such as Advance Payment Bonds enable contractors to receive mobilisation funds without placing the client’s investment at risk

3. Market Confidence

They provide assurance to banks, developers, and public entities that only qualified and solvent contractors are engaged.

The Contribution of Insurance and Reinsurance

In Mauritius, construction bonds are predominantly issued by local insurance companies acting as sureties. However, insurers often have limited capacity. For example, when a large-scale hotel or public infrastructure project requires a performance bond worth dozens or hundreds of MUR millions, local insurers frequently turn to reinsurers for support.

This is where the insurance-reinsurance chain plays a pivotal role:

- Local insurers underwrite the bond, assuming the primary risk

- Reinsurers provide the necessary capacity and technical expertise, which may also include other aspects of the risk landscape around construction projects – e.g. construction risks, marine risks for imports, delay in start-up and advanced loss of profits.

- For especially large or complex projects, facultative reinsurance is employed, where bonds are placed with reinsurers on a case-by-case basis

Before issuing bonds, insurers typically assess:

- The contractor’s financial strength

- Project complexity and duration

- Previous performance and default history

- Collateral or counter-guarantees, where necessary

Relevance to our market

As infrastructure expands, foreign investment grows, and real estate continues to flourish in Mauritius, the scale of projects, and the corresponding need for financial discipline and safeguards, have increased.

Construction bonds now play an important role in:

- Securing public tenders under the Public Procurement Act

- Allowing contractors to compete for international projects where bonding is standard practice

- Meeting banking requirements for loan disbursement, particularly in real estate and hotel development

However, Mauritius faces some challenges:

- Limited local bonding capacity – Few insurers offer surety services, and the limits tend to be lower than in international markets.

- Preference for bank guarantees – Developers and public entities often favour bank guarantees, which can put strain on contractor liquidity.

- Lack of a formal bond underwriting framework – Some contractors struggle to provide audited financials or track records required by sureties.

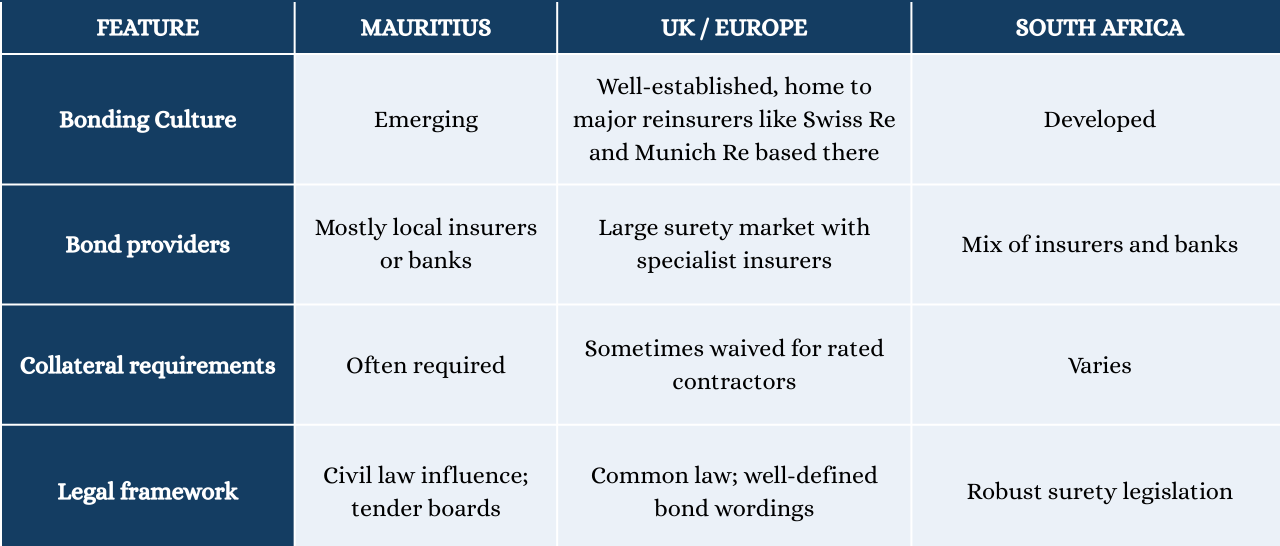

Mauritius vs other markets

Looking ahead

As Mauritius continues to develop large-scale infrastructure, such as metro extensions, port upgrades, and luxury hotel projects, construction bonds will become increasingly central to project risk management.

Key recommendations include:

- Contractors should strengthen relationships with surety providers and enhance financial transparency.

- Expanding reinsurance partnerships will help boost local underwriting capacity.

- The adoption of insurance-backed bonds, as opposed to restrictive bank guarantees, should be encouraged.

- Contractors – particularly SMEs – should receive training on how to prepare for and secure bonds.

Construction bonds may seem like a formality, but in reality, they bring structure, accountability, and financial security to a sector that is inherently unpredictable and high stakes. In Mauritius, as we build bigger, we must also build smarter, and that starts with a robust bond market underpinned by insurance and reinsurance.

____________________________

Construction bonds & FIDIC: what’s the link?

Most major construction projects are governed by FIDIC (Fédération internationale des Ingénieurs-Conseils) contract conditions. These internationally recognised standards allocate risks between clients and contractors. Often overlooked, however, is the fact that FIDIC contracts practically assume the presence of bonds:

• Clause 4.2 requires performance security – usually in the form of a performance bond.

• Clause 14.2 requires an advance payment guarantee.

• The contracts also envisage bonds for retention or warranty obligations.

So, when Mauritian contractors bid for these projects, bonds are not optional, they are embedded in the legal DNA of the contract. Overlooking this requirement places local firms at a disadvantage when competing regionally or internationally.

Without reinsurance support, the Mauritian bond market simply cannot meet the demands of major infrastructure or luxury development projects. As a trusted partner, EllGeo Re delivers bespoke reinsurance solutions for construction projects. We add value by structuring capacity-focused programmes, aligning terms with project and lender requirements, and supporting clients from risk assessment to claims. Our expertise ensures smooth execution throughout the construction insurance value chain: fast, focused, and built to keep construction moving.

Les commentaires sont fermés.