Insurance Coverage for NatCat Losses: Bridging the gap…

Catégorie : Articles

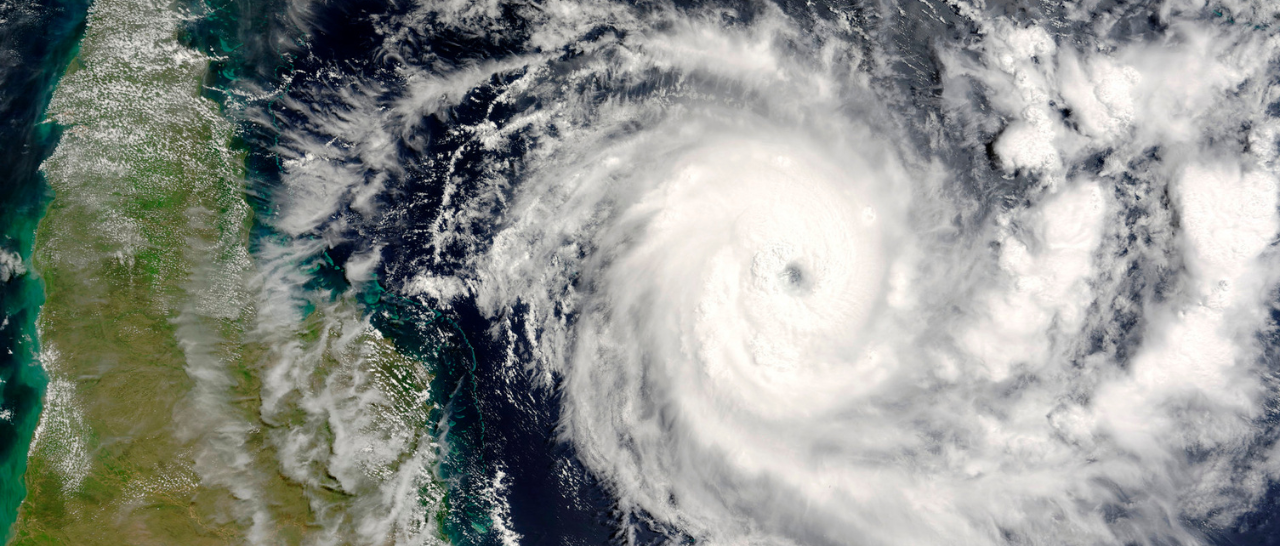

As the world faces an increasingly unpredictable climate, natural catastrophe (NatCat) events, such as cyclones, floods and droughts, have become a central concern for Insurance markets worldwide. For countries like Mauritius and many across Africa, the exposure to these events is growing due to changing climate patterns, rapid urbanisation, and evolving risk landscapes. Despite the growing need for comprehensive coverage, a significant gap remains between Insurance policies and the real risks individuals and businesses face.

In Mauritius, the threat of cyclones is a well-known concern. Cyclone Belal, for example, caused widespread damage. Cyclones are becoming more intense and frequent due to climate change, highlighting the need for better Risk Management strategies. Similarly, on the African continent, countries like Mozambique have faced devastating cyclones such as Cyclone Idai (2019), which caused massive losses, leaving thousands displaced and infrastructure severely damaged. These events are a reminder of the vulnerabilities that many regions, especially island nations and low-lying areas, face when it comes to extreme weather events. Therefore, why is there a gap in coverage for NatCat losses?

This can be attributed to several key factors:

1. Underinsurance and inadequate coverage: In many regions, Insurance penetration is still low, especially for catastrophic risks. This means that many individuals and businesses remain either underinsured or completely uninsured. For instance, a significant proportion of Mauritius’ population lacks sufficient coverage for cyclone damage, despite the high probability of such events.

2. The high cost of premiums: NatCat events often lead to higher Insurance premiums, which can make policies unaffordable for both individuals and businesses. In many African countries, particularly those with limited access to Insurance markets, affordability is a significant barrier to obtaining comprehensive coverage. This is exacerbated by the fact that many Insurers consider the risk of NatCat events to be too high to offer competitive pricing.

3. Lack of standardisation in coverage: In many Insurance markets, coverage for NatCat losses can be fragmented and complex. Policyholders may not fully understand what is covered and what is excluded. Additionally, the variation in policy terms and conditions can create confusion when claims need to be made after a disaster.

4. Inadequate risk modelling and data limitations: In some regions, particularly in parts of Africa, a lack of detailed risk data makes it difficult for Insurers to accurately assess and price NatCat risk. This can lead to either under-pricing (which leaves Insurers vulnerable to catastrophic claims) or overpricing (which makes policies unaffordable for the Insured).

So, what solutions are available?

In fact, to address these challenges, Insurers and Reinsurers must collaborate to create solutions that balance affordability with adequate risk coverage. Here are some strategies that can help close the gap:

1. Innovative risk pricing and index-based Insurance: One potential solution for closing the gap is the use of index-based insurance products. These are based on parameters such as rainfall levels, wind speed, or other indicators of potential damage. For instance, in countries like Kenya, index-based Insurance has been successfully used for agricultural risks, where payouts are triggered automatically, based on measurable parameters like rainfall or crop yield, rather than the actual damage. This approach is faster, more cost-effective, and can help Insurers provide more affordable coverage in regions prone to frequent NatCat events.

2. Parametric Insurance: Parametric Insurance products, which provide payouts based on the occurrence of a specific event rather than assessing actual losses, are gaining traction. These products can be particularly effective in regions like Mauritius or Mozambique, where the occurrence of cyclones is predictable to a degree, but the extent of damage can be difficult to assess immediately. Parametric solutions can offer quick, transparent, and reliable payouts to policyholders, providing immediate financial relief after a disaster.

3. Public-Private Partnerships: Governments and Insurers must work together to share the risk. Governments can play an active role by providing disaster relief funds or subsidies that lower the cost of premiums for at-risk populations. In South Africa, for example, the government and Insurers have discussed options for developing a national catastrophe Insurance pool to protect against the risks posed by flooding, wildfires, and other NatCat events. Such collaborations can help reduce the financial burden on Insurers and improve coverage for individuals and businesses.

4. Technology and Data Integration: Advanced risk modelling techniques, powered by big data, artificial intelligence (AI), and satellite imagery, can help Insurers better assess the risks of NatCat events. In Mauritius, for instance, Insurers could leverage enhanced satellite data to predict the intensity and path of incoming cyclones, enabling them to refine their risk assessments and offer more tailored coverage options. This would not only improve the pricing accuracy but also help avoid the situation where policyholders are either overcharged or underprotected.

5. Education and awareness campaigns: One of the most effective ways to close the Insurance coverage gap is by improving awareness among the general population. Insurers must make an effort to educate potential customers about the risks they face and the importance of Insurance. This could include public awareness campaigns, seminars, and digital platforms that provide easy-to-understand information about NatCat coverage options.

6. Microinsurance for low-income communities: Microinsurance could be a game-changer in African markets. This type of Insurance is designed to protect vulnerable populations against specific risks, such as cyclones or droughts. By offering microinsurance products that focus on specific NatCat events, Insurers can ensure greater coverage and financial security for underserved populations in Africa and Mauritius.

A call to action

Natural catastrophes pose a growing threat to the stability of economies and societies. In Mauritius and across Africa, the vulnerability to such events continues to increase, and Insurers must evolve to meet this challenge. By embracing innovative Insurance models, fostering public-private collaborations, integrating advanced technology, and raising awareness, Insurers can begin to close the gap in coverage for NatCat losses. This will not only help protect individuals and businesses from the devastating impacts of natural disasters but also contribute to building more resilient communities across Africa and Mauritius.

Through collaboration and innovation, the Insurance industry can rise to the challenge of NatCat risks and ensure a more secure future for all.

Comments are closed here.