Reinsurance broking: An essential yet little-known profession!

Catégorie : Articles

Ever wondered what Reinsurance Brokers actually do?

– “So, what do you do for a living?”

– “I work in a Reinsurance Broking firm!”

– After a long pause: “What does that mean exactly?”

If you have ever found yourself in this situation – trying to explain your job to someone outside the insurance world – you’re not alone. While the term Insurance (especially health insurance) is widely understood, Reinsurance and Reinsurance Broking remain unfamiliar concepts to many. In Mauritius, it is rare to hear this sector mentioned as a promising career path (actuarial studies at university being the notable exception). And yet…

The Insurance and Reinsurance industry is incredibly rich – and we are not talking about money here, but about the depth and excellence of the work it involves. First things first…

What do we mean by Insurance and Reinsurance?

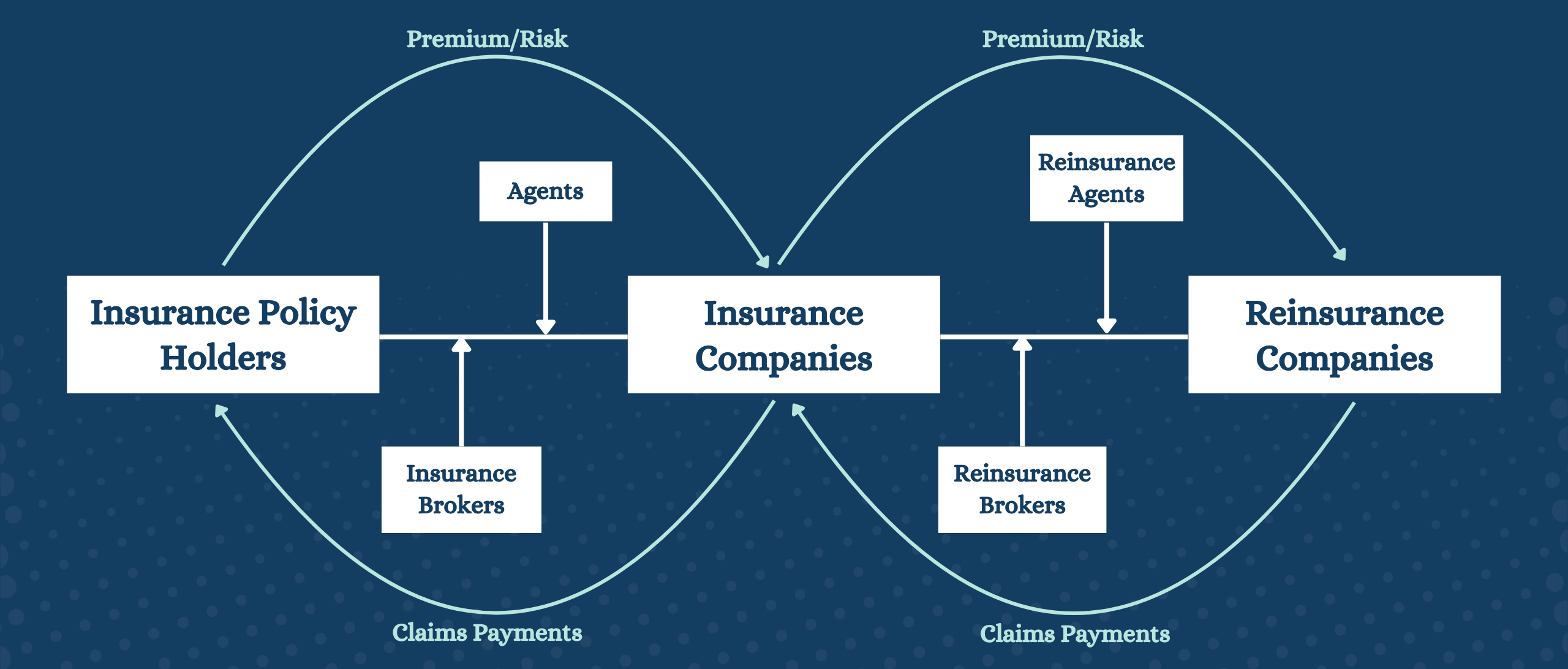

Insurance helps you protect your assets or your financial wellbeing in case something unexpected happens. In exchange for a premium (a sum you pay regularly), the Insurer promises to compensate you if things go wrong. Let’s say you have got a beautiful car. To protect it against accidents or theft, you take out Car Insurance. One day, an animal runs across the road, and you brake too late… The bonnet is completely crushed! The Insurer steps in and pays for the repairs – subject to certain conditions, of course. And what about Reinsurance? Well, it is basically Insurance for Insurers! It means Insurers protect themselves financially by transferring some of their risks to another party – the Reinsurer. Imagine you are planning a huge wedding. It is a lot to handle, so you ask a friend (the Insurer) to take care of everything: catering, music, decoration. But your friend starts to worry: “If I’m responsible for all of this and something goes wrong – like it rains, or the DJ gets sick – it will be a disaster!” So, they call in another friend (the Reinsurer) and say: “Can you take charge of the decorations and drinks? That way, we share the load.”

But the supply chain doesn’t stop there…

Other key players are involved – such as agents and brokers. An agent represents one company only, selling its products and acting on its behalf. A broker, on the other hand, is independent. They act on behalf of the client (the Insured or the Insurer) and search the market for the best offer. To make the distinction clearer: in Insurance, an agent will sell products from just one company. A broker will find the best coverage from several Insurers. In Reinsurance, an agent will represent only one Reinsurer. A Reinsurance broker, like EllGeo Re, works on behalf of the Insurer and looks for the best Reinsurance terms from a range of Reinsurers. Their role includes analysing the Insurer’s needs, finding tailored solutions, negotiating terms, and facilitating communication between all parties.

Where does EllGeo Re stand into all this?

Thanks to our deep knowledge of local markets, wide-reaching network, and technical expertise, we support our clients in managing their risks. Our goal is to find the most appropriate and sustainable solutions to respond to increasingly complex and severe risks – be it natural catastrophes, industrial fires, or other major events. We don’t just place a risk, we take time to understand each client’s specific needs, considering the local, regional, and global context. And who better to talk about what we do than the team members themselves?

Parvesh Boolaky, a Reinsurance Broker at EllGeo Re for nearly four years now, highlights the value placed on precision, agility, and technical expertise: “Our unique approach brings real added value to our clients. From cybercrime to commercial crime, through to energy, aviation, and other sectors, these lines demand far more than basic placement skills – they call for deep understanding, precision, and a healthy dose of agility. At EllGeo Re, we advise, identify market trends, spot gaps in coverage, and tailor strategies for each portfolio. In the world of Specialty Lines especially, opportunities and threats can appear without warning. So, we have to move fast… And get it right. But what really sets us apart is our team spirit. We are a close-knit crew, where skills and experience come together to tackle challenges with creativity – and usually with a smile.”

Alexander Muge Okoth, our Reinsurer Broker from Kenya, shares a similar view: “We are proud to have a team of committed brokers who provide personalised service. We always strive to go beyond simple placements. Our mission? To ensure our clients stay well informed – and always one step ahead.” Now, when it comes to staying ahead, Shanon-Ann Minkley-Ramloll, Assistant Reinsurance Broker and avid golfer, knows a thing or two. Like the rest of the team, she works daily to anticipate challenges, understand evolving needs, and offer constantly adapting solutions. But, as she points out, our relationships with partners are not merely transactional: “At EllGeo Re, we regularly organise training sessions and themed discussions around niche risks, such as event cancellation or ‘hole-in-one’ coverage, while also addressing current topics. And let’s not forget – we make urgency our ally. That mindset perfectly reflects one of our core values: ‘Make It Happen’. In short, we get things done. Efficiently and with purpose.”

And all of this relies heavily on training… Indeed, the company is committed to the personal and professional development of every team member. Through continuous learning, mentoring, and access to a range of resources, each person is encouraged to grow, aim for excellence, and think beyond the obvious. Objective? To become trusted Partners to each of our Clients.

Comments are closed here.